“An era does not just create a technology. Technology creates the era.”

– Brian Arthur, The Nature of Technology

Botticelli never delivered a baby.

His iconic work of the Italian Renaissance, The Birth of Venus, depicts a beautiful young woman rising from the sea, cupped pearl-like in a scallop shell, being gently blown ashore, where an ethereal attendant awaits to enfold her.

I’m sorry, what?

Having had four children, I’ve seen birth up close and personal. Blood, injections, erupting pain – and that’s when things went well. Birth is a bursting forth of something new, and that process is not easy in my experience.

I can only assume Botticelli had something more symbolic in mind: birth as a herald of change. The Birth of Venus was painted in the 1480’s, when the Renaissance was in full swing. Venus is the embodiment of its beautiful and powerful ideals, a harbinger of a new world full of promise. More than 500 years later, she still is.

On January 3, 2009, when Satoshi Nakamoto mined Bitcoin’s genesis block, he brought Bitcoin into being. Bitcoin was a breakthrough for a specific problem that the “cypherpunks” had been working on for many years: how to move value electronically without the risk of double spending or the need for a financial institution. Satoshi’s method of recording transactions on a blockchain, an immutable ledger, and verifying them by a process called proof of work, a method of ensuring the integrity of ledger entries without the need for a trusted intermediary, provided an elegant solution.

But was his “Venus” simply a clever answer to the complex problem of a peer to peer electronic cash system? Or was it something more fundamental, the introduction of tools and concepts that broaden the innovation landscape, opening possibilities we are only beginning to explore?

If you are a “Bitcoin Maximalist,” you tend to the former. If a Web3 enthusiast, you’re inclined to the latter.

The answer lies, we think, in the potential for Satoshi’s creation to provide the building blocks for other innovations. There is reason to believe the potential is enormous.

In 2013, 19-year-old Vitalik Buterin combined blockchain and proof of work with another innovation, “smart contracts,” to create Ethereum, now the dominant platform for digital asset applications with a revenue run rate of over $14 billion.

Buterin is not alone. Developers and entrepreneurs have created thousands of digital tokens and applications. Hundreds of millions of people globally have used them. Their collective value excluding Bitcoin exceeds $1 Trillion. So much talent is flooding into digital assets that Korn Ferry, a leading employment consultant, recently issued a report entitled A Talent Drain You Can’t Ignore: Cryptocurrency.

(source: coinmarketcap.com)

(source: coinmarketcap.com)

Is this enthusiasm overdone, unmoored from fundamental factors? We don’t think so.

Decentralized, tokenized networks allow for a new kind of collaboration between entrepreneurs and their customers. Entrepreneurs can quickly assemble new products and services using blockchains, proof mechanisms and “smart contracts.” Network participation is motivated by incentives; few if any employees may be required. Capital investment is light. Early customers may get the sort of benefits usually reserved for venture capitalists – an economic stake in the network, the opportunity for enormous returns as the network value grows, a say in policies and governance.

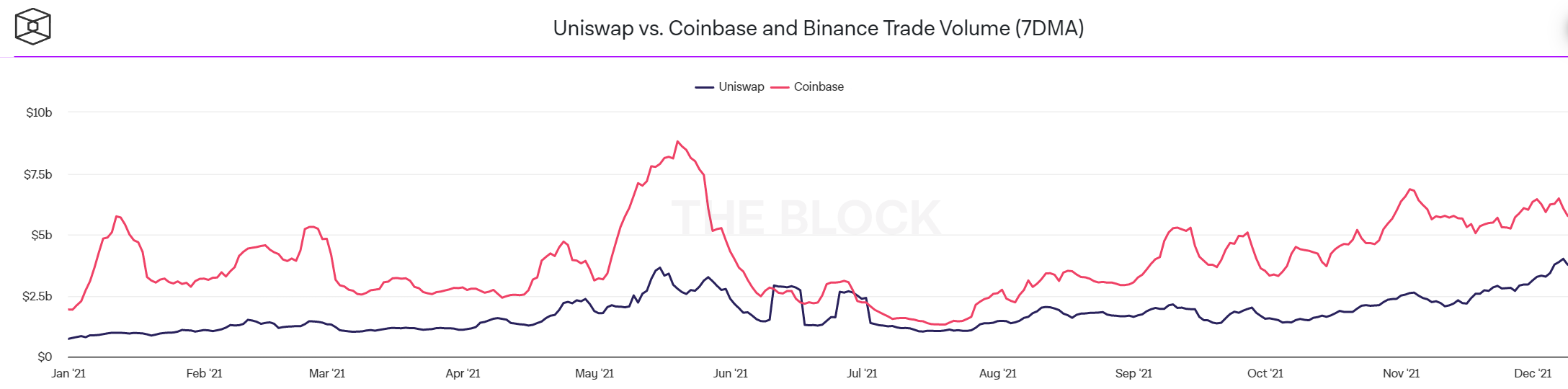

Take the decentralized exchange Uniswap, an automated market maker for digital tokens built on Ethereum. Uniswap launched in 2018 and quickly began attracting users. In September 2020, Uniswap announced it would be overseen by the holders of UNI, its new governance token. Uniswap “airdropped” (granted) each of its users a minimum of 400 UNI, which at an initial trading price of about $3 was a $1,200 windfall. UNI now trades at about $18, making the airdrop worth over $7,000 for those who held it. Uniswap has only a small number of employees (less than 50), but UNI token holders control major decisions. Over the past three months, trading volumes on Uniswap have averaged over $1 Billion per day; its market capitalization is now $10 billion. Uniswap has created significant value and network participants have been major beneficiaries. (note: we own UNI in the fund).

(source: The Block Research)

There is growing evidence that some of the largest companies in the world also see digital assets as part of a growing digital reality that increasingly will engage us all.

Investments in the metaverse – immersive, persistent virtual worlds where people can work and socialize that frequently rely on digital assets to create virtual property and other features – and NFTs (unique tokens) are great examples. Facebook changed its name to Meta in September 2021, reflecting its future focus as a metaverse company. Microsoft and Disney announced their own metaverse strategies in their most recent quarterly calls. In December 2021, Nike bought RTFKT, a (pronounced “artifact”), a leading designer of digital shoes and other NFT products. Budweiser and Adidas recently offered NFTs to their fans at relatively nominal prices and sold out immediately – these NFTs are now selling at multiples of the original prices on trading platform opensea.io.

In our view, digital assets are both important and distinct from other assets. Following their volatile and sometimes chaotic infancy, digital asset markets are gradually maturing. We believe they merit attention from all investors. Perhaps they are even a new Venus arriving on our shores, cupped in cryptography and enfolded in a blockchain, signaling the arrival of a promising new age.