Runa TL;DR – EOY/Dec 2022

This blog post is a special edition of Runa’s TL;DRs. It recaps the year by sector.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Currencies

2022 Performance: -64.19%

By: Alex Botte

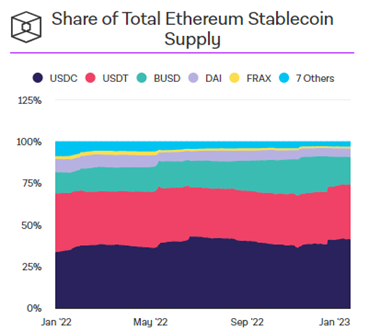

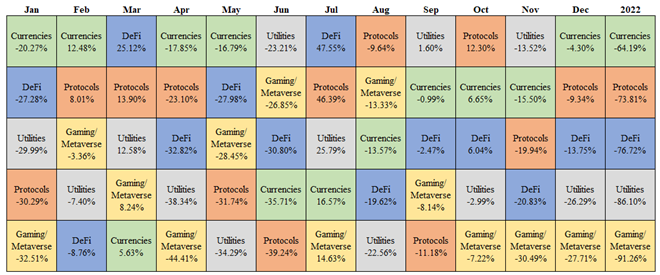

- Bitcoin ended the year -65%, registering its worst calendar year performance since 2018 when it fell -73%. Despite its large decline, bitcoin was actually one of the best performing digital assets, outperforming the average token in our sector universe by 15%. Bitcoin is one of the least volatile and most mature digital assets, making it one of the “safe haven” coins in this asset class.

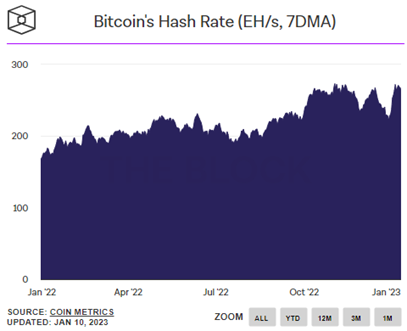

- Fundamentally, the Bitcoin network performed well given the tumultuous year for digital assets. Metrics like network transactions and active addresses were effectively flat for the year, while hash rate (the amount of computing power that is securing the network) increased. The latter is particularly impressive given how terrible of a year it was for bitcoin miners – there were bankruptcies, lawsuits, and executive turnover at many of the top mining firms.[1] It was a perfect storm: interest rate hikes increased miners’ cost of capital, and higher electricity costs increased miners’ expenses, while bitcoin’s price dropped, reducing miner revenues.

source: Bitcoin Charts: Active Addresses, Hash Rate and Miner Revenue (theblock.co)

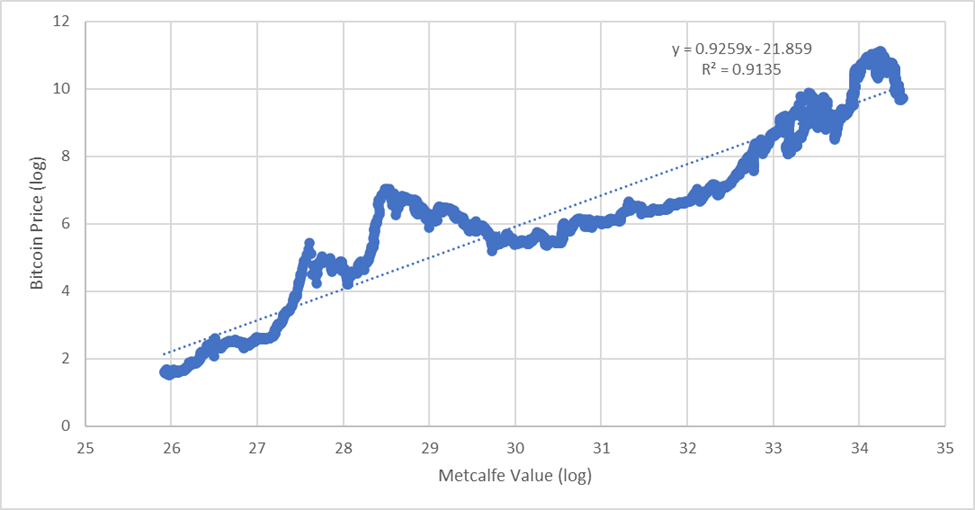

- In a video this year we described how Metcalfe’s law, a measure for network effects, can be used to value bitcoin. According to our version of Metcalfe’s law that uses Bitcoin address count, bitcoin is trading at about a 30% discount relative to its fair value as of the end of 2022. This is of course just one metric one can use to understand bitcoin’s value.

- Aside from bitcoin, another asset within the Currencies sector that we are watching closely in 2023 is Ripple ($XRP) and its ongoing lawsuit with the SEC. In December 2020, the SEC initiated legal action against Ripple for allegedly selling unregistered securities. XRP is the sixth largest digital asset by market cap, and we believe the verdict in this case could materially impact the digital asset markets.

Protocols

2022 Performance: -73.8%

By: Max Williams

- Tron (-28.8%) was the best performer in the Protocol sector in 2022. While not having much of a DeFi ecosystem, Tron became the preferred blockchain for tether’s USDT stablecoin holding over $30b in supply to end ‘22. Tron may have benefited from not being a popular investment due to controversial founder Justin Sun.

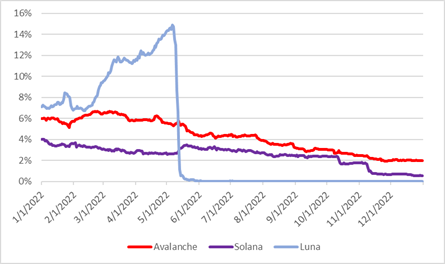

- SoLunAvax: Entering 2022 the trending trade was a basket of alternative base-layer protocols being viewed as likely to surpass Ethereum as the sector leader. The trending basket in Q1 was SOL, LUNA, and AVAX each having raised 9-figure VC rounds in late ‘21, early ’22. An equal-weight portfolio of the three tokens would have returned -94.8% for the year.

- Solana (-94.2%) – Solana looked to ride its 2021 momentum into 2022 and was off to a strong start with its StepN application becoming the newest gaming craze in Q1 ‘22. However, bear market conditions delivered brutal blows to the solana ecosystem as it dealt with multiple hacks and DeFi exploits. Finally, its association with FTX and SBF sent the token down 70% in Q4 alone as its flagship DEX was incubated by SBF.

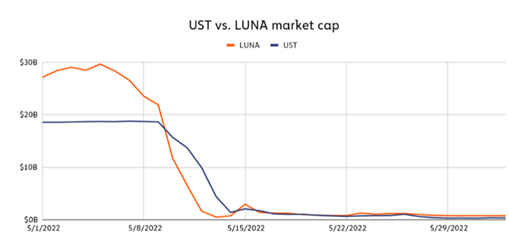

- Luna (-99.9%) – Relied on the growth of its native stablecoin UST and its lend/borrow application Anchor to build a DeFi ecosystem. UST depegged in May and brought down Luna with it sending contagion rippling through crypto markets that is still being felt.

- Avalanche (-89.7%) – The Avalanche Rush incentive program was used to bootstrap growth on the chain leading to ~$9b in TVL for much of Q1 and Q2 of ‘22. The Luna collapse decimated DeFi activity everywhere and AVAX TVL has fallen to below $1b. Circulating supply grew by 63% in 2022 as early investors vested tokens putting further sell pressure on AVAX.

Total Value Locked (TVL) Market Share – Protocols

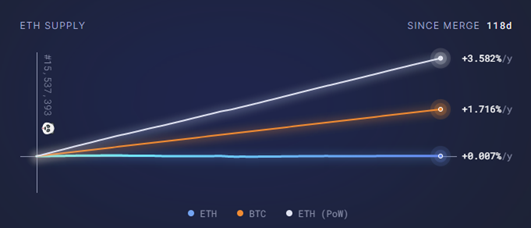

- Ethereum (-67.9%) was not shielded from the widespread bear market but it did show its role as a relative “safe-haven” outperforming the sector and just barely trailing BTC. ETH had one of its worst quarters in its history in Q2 (-68%) but from our view much of this was the result of CeFi lenders liquidating the collateral of its defaulted borrowers, much of which was ETH. The Ethereum Merge was finalized in Q3 and was a revolutionary upgrade not only to Ethereum’s codebase but also the investment merits of ETH by reducing its supply growth to almost flat YoY. Ethereum finished 2022 +48% from its June low.

ETH Annual Supply Growth as PoS vs. PoW Network

Source: 36 Gwei | $1,474 | ultrasound.money

- What to watch in 2023:

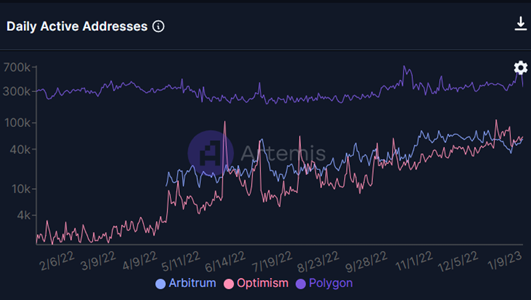

- Layer 2 protocols – Polygon and Optimism are both seeing positive trends in fundamentals and reaching all time highs in active users in late ‘22. Both have bounced strong in H2 ‘22 up 65% and 71% respectively. Ethereum developers plan to include software upgrades in ‘23 that would reduce fees for L2 usage benefitting users on L2 chains like Polygon and Optimism.

Ethereum Layer 2 – Daily Active Addresses

Source: GokuStats by Artemis

-

- Cosmos/ATOM 2.0 – The app-chain thesis and technology that Cosmos has built finally received the attention it deserved in ‘22. One of the largest DEXs, dydx, announced it will migrate away from the Ethereum ecosystem to Cosmos at some point in ‘23. We expect others to follow and a much needed upgrade to ATOM to bring positive change to Cosmos in ‘23.

- Deep value – Is Solana dead? Does deep value exist in digital markets? Solana has been written off by many as a fun but failed experiment. However, we are not as sure the Solana ecosystem can be so easily dismissed. The technology is undeniably more performant than many others at scale and they have the right long-term partners in Jump Trading. The question is – at what price?

- Aptos – The most anticipated and highest profile token launch event of 2022 due to its 10-figure private valuation by VCs in early 2022. The token and mainnet launched in Q4. We found the $9b valuation at launch questionable at best for a product with limited fundamentals. We will be paying attention to the developer ecosystem and benefits that come from supporting the move programming language.

DeFi

2022 Performance: -76.72%

By: Alex Botte

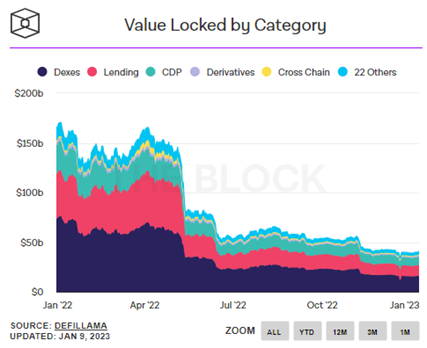

- Total value locked, a popular DeFi metric that aggregates the dollar value of assets held within all types of DeFi protocols, fell dramatically in 2022 from $165B to $40B. This was partly due to depreciating token prices (as TVL is valued in dollars here) as well as assets leaving the DeFi ecosystem. The space suffered particularly in May 2022 following Terra Luna’s collapse outlined in the Protocols section, as the Terra blockchain had a DeFi protocol called Anchor that allowed depositors of Terra’s UST stablecoin to collect, or “farm,” a yield of ~20%. The yield went away when the Terra ecosystem collapsed, and it brought down much of DeFi with it.

Source: Value Locked in DeFi Charts: Ethereum and Binance Smart Chain (theblock.co)

- In the months that followed Terra’s collapse, several centralized crypto companies, such as Celsius, BlockFi, and Voyager, filed for bankruptcy. Some of these companies “rehypothecated” customer funds by using them as collateral to take out overcollateralized loans in DeFi protocols like Aave and Maker. The DeFi lending protocols held up very well during these firms’ liquidations, as they were the first to get paid. Once a DeFi loan becomes undercollateralized, liquidations are automatically triggered by code, and the entire process is transparent on-chain. We think it’s important to note the distinction between centralized companies and DeFi protocols. The former failed due mostly to poor risk management and asset-liability mismatches, while the latter held up relatively well during the massive deleveraging and cascading liquidations that resulted from these companies’ failures.

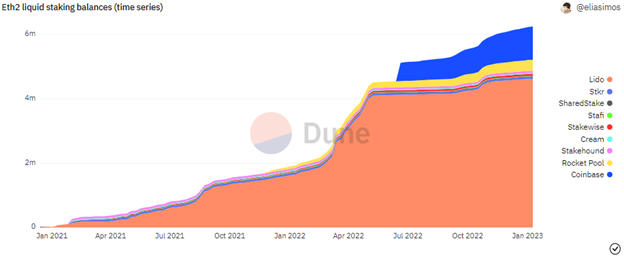

- Liquid staking is a notable sub sector within DeFi that gained in market share and overall importance during 2022 largely because of Ethereum’s move from PoW to PoS. It ended the year as the #3 DeFi category by TVL (behind decentralized exchanges and lending protocols). Liquid staking protocols allow users to pledge or “stake” their assets with validators that secure PoS blockchains like Ethereum and Solana. Users receive a derivative token representing their staked assets that can be used in other DeFi protocols. The benefits of liquid staking are participating in network validation and block rewards while not losing the opportunity to participate in other DeFi activities. The ETH liquid staking market leader is by far Lido, followed by Coinbase. Lido is a decentralized DeFi protocol and has been around for years, whereas Coinbase’s solution is of course centralized and relatively new to the market.

Source: Eth2 liquid staking balances (time series) (dune.com)

- Some DeFi-related activities we’re watching in 2023:

- Uniswap is the largest decentralized exchange (DEX) by volume – it has about 60% of all DEX volume as of early 2023. Currently all the trading fees are paid out to those supplying liquidity to Uniswap’s trading pools. In early December, a proposal passed to experiment with lowering the share of fees that these liquidity providers receive in a few of Uniswap’s trading pools. This has the potential to eventually accrue value to UNI tokenholders by allowing them to directly or indirectly participate in the fees generated on Uniswap. Token value accrual in general is a topic we are focused on. Read our report here on the different ways DeFi protocols accrue value for their tokenholders.

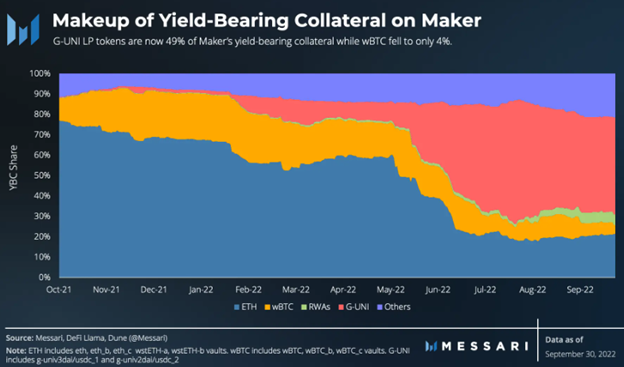

- DeFi’s self-referential activity has been a criticism of the sector (e.g., take out a loan on Aave for leveraged trading of assets on Uniswap). However, there are an increasing number of examples recently of non crypto-native businesses and other activity turning to DeFi. For example, decentralized peer-to-peer lending protocol, MakerDAO, enables overcollateralized loans in their stablecoin, DAI. A key growth initiative for them is “Real World Assets” (RWA) being used as collateral for these loans. As of Q3 2022, the RWA collateral type saw the largest increase of 336%. RWA collateral includes bonds backed by home loans and cargo and freight invoices. We are bullish on opportunities that bring in outside information and “real world” use cases to closed blockchain networks to break the circularity in DeFi.

Source: Crypto Research, Data, and Tools | Messari

Utilities

2022 Performance: -86.10%

By: Charlie Perkins

What happened in 2022:

- Down 86% in 2022, utility tokens saw huge declines across the sector. Despite the high expectations for many projects to lay the groundwork for the Web3 ecosystem, almost all projects were impacted by the greater market pullback. Bear markets are often claimed to be the best time to build, and many projects did just that. While the majority of these projects are yet to see their time in the limelight, they are very much challenging how large centralized industries operate. It remains extremely early for the full implementations of robust blockchain solutions, as centralized alternatives remain cheaper and easier to use. While 2022 very much slowed its progress, the crypto utility sector is poised to drive growth in Web3.

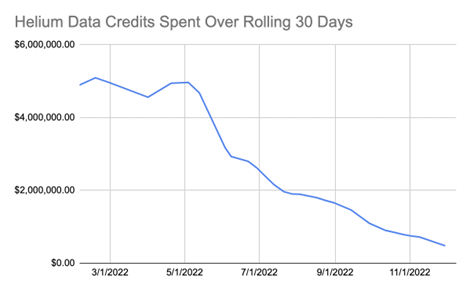

- Decentralized wireless (DeWi) project Helium (-95.92%) gained traction early in the year with hopes of utilizing their LoRaWAN network to power IoT solutions such as lime scooters. Helium’s growth fizzled after Q1 and usage of the LoRaWAN network tumbled by more than 70% using Data Credits spent as a proxy. Helium has since launched an additional network supporting the 5G evolution. While it is extremely nascent, Helium’s 5G network aims to provide 5G capacity with improved coverage and security at a lower price point. In November, Solana announced that it was partnering with Helium and T-mobile to power its Solana Saga Smartphone.

- Decentralized file storage has been an expanding concept within the Web3 world as a way to fully decentralize crypto projects. Despite taking a hit in 2022, projects such as Filecoin (-91.33%), Arweave (-89.76%), and Storj (-86.07%) are working to offer greater decentralization. While digital assets are inherently decentralized by nature, centralized companies have begun to take a larger role in project operations. For example, although NFT ownership is deployed on a blockchain, the actual image may be stored on a centralized server. Illustrating this trend, in November, Meta announced that they were partnering with Arweave to store Instagram digital collectibles.

- Ethereum Name Service (-73.27%) domains have been widely accepted by the Ethereum community as the standard on-chain ID and integrated with many popular projects. ENS domains replacing Ethereum’s 64 character alphanumeric addresses has been instrumental in improving the Ethereum user experience. In September, Coinbase began providing Coinbase Wallet users with ENS names ending in “cb.eth,” leading to more widespread recognition of the need for human-readable addresses. Throughout 2022, users flocked to register short and unique addresses before they all sold out, leading to various spikes in domain registration. However, as the unique domains have sold out, domain registrations have slowed way down.

Source: Weekly ENS Domain Registrations (1 Year) (dune.com)

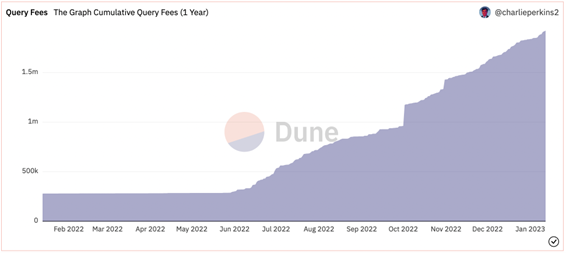

- In 2022, a large number of centralized and decentralized projects worked to provide seamless access to the wealth of data stored on Blockchains such as Ethereum. The Graph (-91.52%) is one such solution that has become a staple for dapp developers. In June, The Graph sunsetted its hosted service and migrated all subgraphs to become fully decentralized. While The Graph was among the worst performing tokens in the sector, the project is currently encountering increasing query fees, seeing a 27% increase in Q3 and 5% in Q4 despite a slowdown in the crypto economy. Additionally The Graph has made large grants to data providers such as Messari in an effort to expand subgraph developments. The Graph is yet to hugely catch the investor’s eye as it continues to be a very foreign concept to many traditional technologists.

Source: The Graph Cumulative Query Fees (1 Year) (dune.com)

What to watch in 2023:

- It is not a secret that the cloud computing business has blown up incredibly over the past 3+ years, as AWS, Google Cloud and others rake in profits from essentially enabling our digital livelihoods. Blockchain technology provides opportunities for the trustless exchange of computing power for a cheap cost at a massive scale. As the opportunity grows, projects such as Akash and Ankr (-84.85%) are well poised to offer cheaper and more secure decentralized cloud computing. Additionally, concerns around Ethereum’s decentralization are beginning to arise as two-thirds of Ethereum nodes are now run on centralized clouds and about 50% of all Ethereum nodes are on AWS. In 2023, decentralized cloud computing networks may be a necessity for preserving Ethereum’s security.

- Being one of the earliest Web3 utility projects, Chainlink (-72.33%) has cemented its use case in the blockchain development space. Bringing off-chain data on-chain serves an incredibly important piece in securing applications all across the decentralized ecosystems. In the aftermath of 2022’s many insolvencies and mishandlings, transparency has become an essential aspect for many firm operations. Chainlink’s Proof of Reserve product does just this, securely providing validation of firm holdings off-chain. Going forward, solutions such as this can help to equip stakeholders and the greater community with secure data on the financial stability (or instability) of various counterparties, allowing teams to act quickly to preserve Web3’s progress and stability.

Gaming and Metaverse

2022 Performance:-91.26%

By: Ned Menton

- 2022 started as a year of excitement for this sector. Facebook had recently announced their new name, Meta, and new focus on metaverse development, a move which led to massive gains for Web3 metaverse tokens like Decentraland and The Sandbox. Web3 gaming had just begun to gain some real traction, with titles like Axie Infinity exploding in popularity. However, during the year we learned that experience is king in this sector and that in order to garner real usage, developers need to create compelling content that users will learn to love.

2022 Post-Mortem

- As stated above, interest in metaverse-related tokens was at an all-time high going into 2022. The value of tokens like Decentraland and The Sandbox skyrocketed following Facebook’s announcement. However, during 2022 as investors saw the poor quality of their current product offering these tokens took significant losses, with Decentraland -91.1% and The Sandbox -93.6%. The metaverse, despite being an exciting concept, will be one of the most technically challenging projects in the history of entertainment. While we may be a long time away from a full metaverse experience we continue to research opportunities in this space.

Source: tradingview.com

- 2022 was also a trying year for titles in the Play to Earn gaming space. Titles such as Axie Infinity (-93.6%) offer their users the unique opportunity to earn monetary rewards for time they spend playing a game. This opportunity led to a significant level of user interest, as individuals flocked to these games in droves excited by their earning potential. In 2022 we saw just how fragile these types of models can be, in the case of Axie Infinity the profitability of playing the game decreased, leading profit driven users to abandon the game thereby crashing the in-game economy for all users. This vicious cycle led to the game’s daily revenue decreasing from ~$700K at the beginning of the year into the low four digits at year-end. This collapse is indicative of a larger issue in Web3 gaming: historically monetization has been put before user experience. This creates the ever present possibility that large swathes of the game’s user base could leave at any moment should the in-game economics deteriorate.

Source: Axie Infinity (AXS) – Index | Dashboard | Token Terminal

Looking Forward to 2023

- AAA Blockchain Gaming: As mentioned above, a major problem in the past for Web3 games is that their users are typically economically incentivized to play the game as opposed to recreationally. We’re excited about games which plan to put experience first. Illuvium is one example of this. The Illuvium team is building a “AAA” quality game, meaning the experience should be technically similar to console and PC experiences which already garner tens of millions of returning users. While it is nearly impossible to know whether any single game will capture public interest, creating immersive and fun experiences is an important step to draw traditional gamers into this space.

- Sports-related properties continue their growth: Increasingly many blockchain projects have looked to leverage individuals’ love for their favorite sports teams. This strategy has created many successful blockchain projects such as NBA Top Shots and Sorare, but this year Chiliz (-65.0%) was a significant outperformer. Chiliz allows users to purchase “fan tokens,” which grant them voting rights on decisions made around their favorite teams. Today the market cap of all Chiliz fan tokens exceeds $190M, demonstrating the level of interest in this type of product. Chiliz’s success is a testament to the value of established brands such as sports teams.

Stablecoins

By: Max Williams

- Stablecoins are one of the most compelling use cases of blockchain technology that exists today. The ability to instantaneously transfer assets digitally across borders without a centralized intermediary for low to no cost offers clear and obvious benefits. Several governments continue to develop plans for a central bank digital currency (CBDC) with use of blockchain technology. As recently as January 11th officials in the UK embraced the idea of using a privately issued stablecoin for wholesale settlements within the banking system. The sector is an important one to facilitate activity within not only the crypto economy but also the traditional financial system and sure to be an area of regulatory focus in 2023.

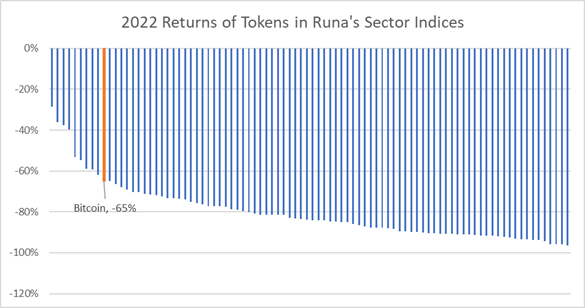

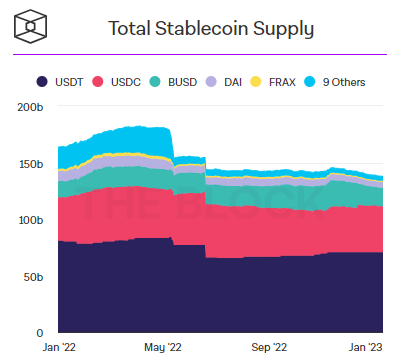

- Total Stablecoin Supply peaked at just over $180B in Q1 and now sits at $140B. While total supply outstanding contracted in 2022, it is still more than 4x the size it was in January 2021.

Source: Stablecoin Supply Charts and Banned Tether (USDT) Addresses (theblock.co)

-

USDC became the market share leader for stablecoins on Ethereum, surpassing USDT in early 2022. USDC, which is issued by Circle, emerged as a safe haven during a flight to quality as further questions arose around the reserves backing Tether’s USDT.

Source: Stablecoin Supply Charts and Banned Tether (USDT) Addresses (theblock.co)

- In what will be remembered as the spark that lit the fire of this bear market, the depegging of algo-backed stablecoin UST and subsequent crash of LUNA, UST’s issuer, was likely the end of algorithmically backed stablecoins. However, Maker DAO, who issues a crypto-backed stablecoin DAI, still has more than $5B in supply outstanding showing that there is demand for a decentralized stablecoin.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com

Disclaimer: The information presented should not be considered a recommendation to purchase or sell any asset and should not be relied upon as investment advice. Any data cited herein is from sources believed to be reliable, but is not guaranteed as to accuracy or completeness. The views expressed in this note reflect those of the investment team at Runa Digital Assets as of the date of posting. Any views are subject to change at any time based on market or other conditions, and Runa Digital Assets disclaims any responsibility to update such views.