This blog post recaps Runa’s TL;DRs in April and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance:

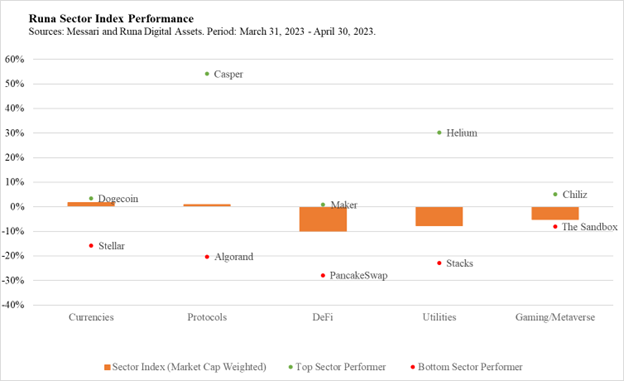

- April delivered an up and down month for digital assets with ETH and BTC reaching YTD highs, yet altcoins lagged behind. Currencies and Protocols continued to build off their strong start in Q1 and ended slightly positive, while all other sectors ended the month lower.

- Casper (+54%) was the month’s top performing asset. Casper is a smart contract platform built with enterprise use cases in mind. They have recently announced partnerships with Google Cloud and SkyBridge Capital.

- Helium (+30%) decoupled from the market and the Utilities sector in April thanks to a successful network upgrade. Helium migrated their network, with almost 1 million IoT and 5G hotspots, to Solana (+7%) for increased network performance and developer support.

Notable News:

- Ethereum successfully completed another milestone achievement, the Shapella upgrade, again without significant issues. The upgrade enabled ETH stakers the ability to withdraw their deposits that had previously been illiquid. ETH shrugged off investor concerns of sell pressure related to the upgrade and crossed the $2,000 level for the first time since August 2022.

- On April 20th, EU lawmakers voted to approve MiCA, Markets in Crypto Act, which sets forth a regulatory framework for token issuers and service providers in the crypto asset ecosystem in Europe. The rules will go into effect in 2024 and are designed to be an initial step to a more comprehensive framework being developed. Notably, digital asset exchanges Coinbase and Gemini recently launched new international product offerings as a result of the regulatory environment in the US.

- T.Rowe Price, Wisdom Tree, and Wellington are among the large traditional financial institutions that announced a partnership with the Avalanche blockchain to make trade execution and settlements more efficient.

- Starbucks dropped their second NFT collection, First Store, on the Polygon blockchain. Their on-chain rewards program, Odyssey, has been in beta and is expected to publicly launch soon. The NFTs come with 1,500 Starbucks rewards points. We think this is a great example of a non-crypto native company using blockchain technology to deepen their engagement with customers and to provide actual utility through NFTs.

Notable Data

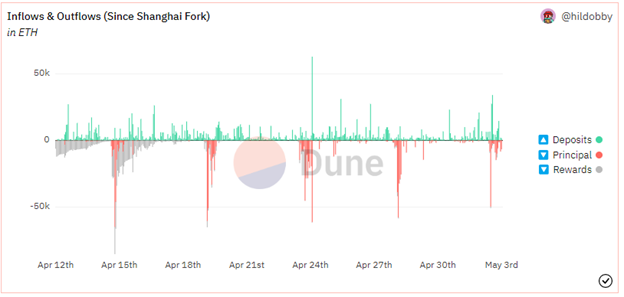

- All eyes were on the deposit and withdrawal queue once Ethereum’s Shapella upgrade went live on April 12th. As expected, the withdrawal queue quickly filled up as existing stakers sought to unstake after being illiquid for up to 2 years. Deposits are now beginning to outweigh withdrawals, and the amount of ETH staked is almost back to pre-Shapella levels. Read our report on the Shapella upgrade here.

- One potential motivation for unstaking an ETH position would be the intention to re-stake using a liquid staking provider like Lido or Rocket Pool. Liquid staking services provide a receipt token that trades freely in DeFi markets and may offer capital efficiency. Lido is the category leader with over 70% market share among liquid staking services and 31% of all staked ETH. The increase in both staking participation post-Shapella and on-chain activity has led to a continued surge in Lido’s daily revenue, which reached ATHs in April.

Runa Updates

- Runa’s Head of Client and Portfolio Solutions, Alex Botte, CFA, CAIA, recently published another report on crypto-specific risk models. In this piece, Alex explains why a sector-based risk model in crypto can provide valuable insights to investors. Read her report here.

- More Content: Alex Botte, CFA, CAIA was featured on Arbor Digital’s Asset (r)Evolution podcast to discuss her industry leading risk research. You can listen to the episode here.

- The Runa team will be on the road in May at The Bitcoin Conference in Miami and AIMA’s Digital Asset Conference in NYC. If you’ll be attending, we would love to meet with you.