This blog post recaps Runa’s TL;DRs in February and is meant to cover the most interesting token performers, crypto data, and news from the month.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance:

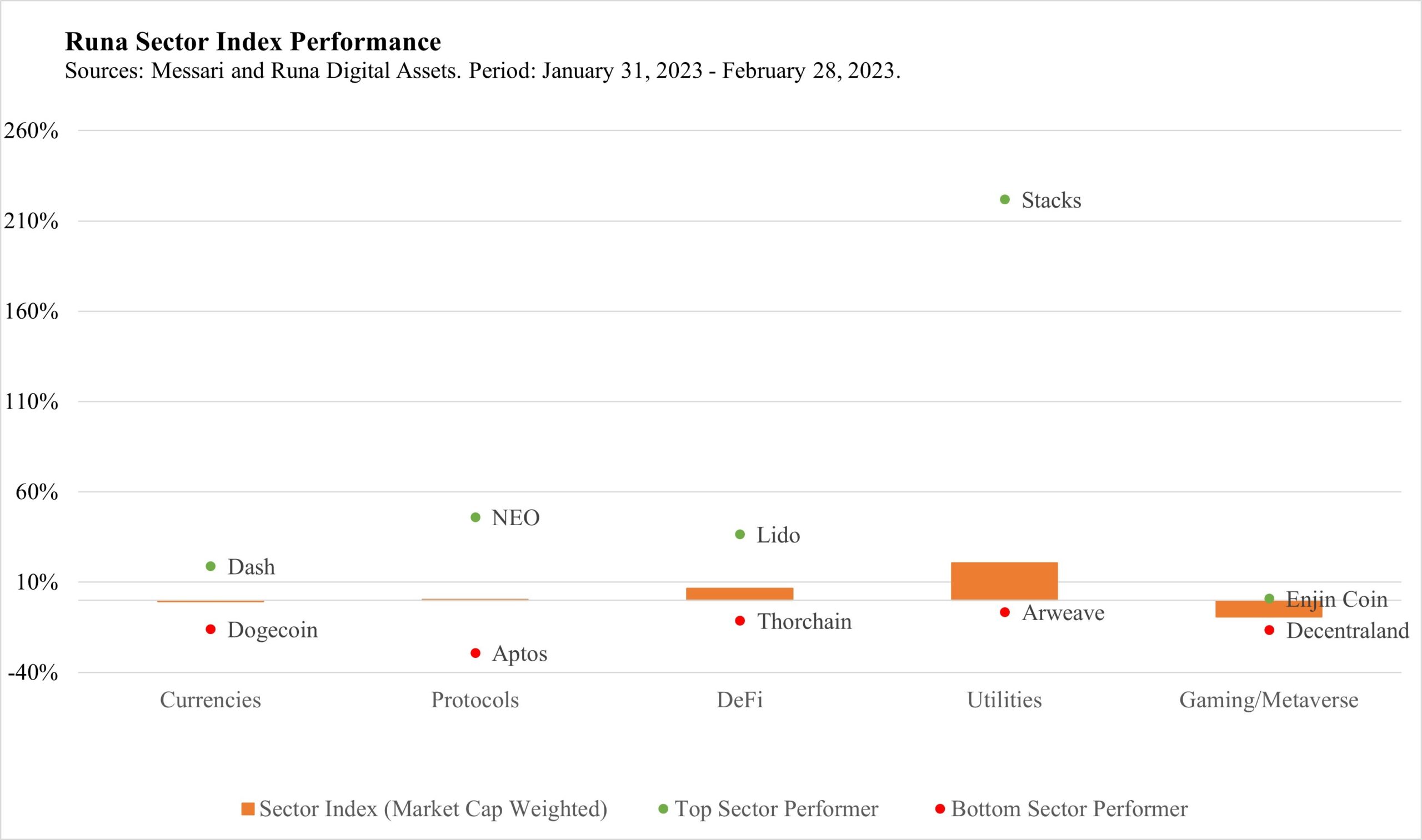

- Runa’s sector indices were mixed for the month. Markets cooled down after a strong start to the year due mostly to an increasingly unclear macroeconomic situation and a regulatory crackdown on the crypto industry. On the regulatory front:

- An SEC enforcement action against Kraken Digital Asset Exchange negatively impacted the markets, as the centralized exchange shut down its staking-as-a-service business for U.S. retail customers, which was deemed by the SEC to be an unregistered securities offering with insufficient risk disclosures. This immediately boosted tokens of liquid staking protocols like Lido Finance (+37%), as the expectation was that Kraken staking customers would move to decentralized alternatives.

- The SEC said Binance’s BUSD stablecoin issuer, Paxos, should have registered the stablecoins as issuing securities, and the NYDFS claimed Paxos had insufficient risk assessments and due diligence of Binance. Paxos announced they would cease issuing BUSD at the instruction of the NYDFS.

- The SEC charged Terraform Labs and Do Kwon (the creators of the Terra blockchain that famously imploded in May 2022 with the death spiral of its algorithmic stablecoin, UST). The SEC is effectively claiming that all types of digital assets in the Terra ecosystem were securities, including UST and synthetic assets that tracked equity securities on Terra’s Mirror protocol. They also assert that Kwon fraudulently misled investors.

- BTC (+0%) and ETH (+1%) were effectively flat.

- Utilities (+21%) was the best performing sector, lifted largely by Stacks (+222%) and The Graph (+72%).

- Stacks is a Bitcoin layer-2 for smart contracts that allows developers to build applications on the Bitcoin blockchain similar to those built on Ethereum, Solana, and other layer 1 smart contract platforms. Stacks has benefitted from the hype surrounding Ordinals, which in short allows for on-chain data inscriptions in various forms (images, texts, videos, etc.) on Bitcoin.

- The Graph was a beneficiary of the AI narrative that seemed to captivate markets and some parts of crypto Twitter. Its fundamentals also improved: active indexers, unique dapps performing queries, and active subgraphs were all accelerating.

Notable Data:

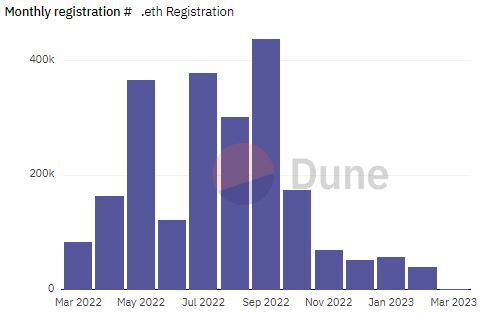

- ENS (-4%), the domain name service protocol built on Ethereum, was the second to worst performer in the Utilities sector this month. Fundamentally, registrations of domain names have slowed in recent months following an uptick last September around The Merge. We believe the next catalyst for the protocol could be the deployment to mainnet of the “namewrapper” smart contract, which would allow .eth holders to create subdomains like alex.runa.eth that could then be sold, rented, or transferred as separate NFTs.

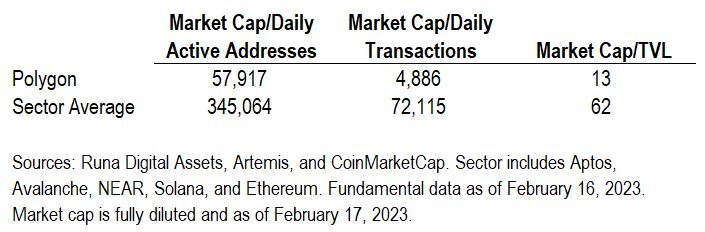

- Polygon (+8%) announced that their EVM compatible zero-knowledge rollup, a layer 2 scaling solution fully secured by Ethereum, will launch on March 27th. We at Runa are excited by the Polygon team’s multi-pronged approach to developing blockchain technology. Their Proof-of-Stake sidechain to Ethereum has strong fundamentals, especially compared to other protocols (see the below table with valuation multiples for Polygon versus competitors), and is the chain of choice for many corporate Web3 initiatives, including those of Meta, Nike, Reddit, and Starbucks.

Notable News:

- Coinbase announced Base, their Ethereum layer 2 (L2) network that is built using the OP (Optimism) Stack, a set of software that can be used to create new L2s. L2s, which are scaling solutions for Ethereum, have seen incredible traction, with Optimism and Arbitrum experiencing 22x and 9x growth in daily active addresses respectively since April 2022. Coinbase has the potential to bring tens of millions of new users on-chain through Base. While Base is only in the testnet phase at the moment, many well-known Web3 projects, including Magic Eden, Aave, Sushiswap, Chainlink, and Balancer, announced partnerships with Base. We think there are many beneficiaries of this development, including Ethereum (Base fees will be paid in ETH) and Optimism (Base was built on the OP Stack enabling it to eventually seamlessly interact with other OP-built chains + a portion of Base fees will go towards OP Stack development).

- In more Polygon news, Hamilton Lane and Securitize announced a partnership with Polygon to release tokenized shares of Hamilton Lane’s $2.1 billion flagship fund. This partnership will leverage blockchain technology to provide individuals with access to what would otherwise be an exclusive private equity product. Partnerships such as these are emblematic of the power of tokenization to bring otherwise inaccessible financial products to the masses.

- Ever since Elon Musk’s acquisition of social media platform Twitter, many individuals in the digital asset industry have hoped that Musk would allow for crypto assets to be used for payments on the platform. These hopes were burgeoned this month when a report from the Financial Times suggested that Twitter may allow for crypto payments following a launch of fiat payment rails. You can read the full Financial Times story here: https://lnkd.in/df_Kz5Qd

- Metaverse news and token performance were mixed this month, with Decentraland (-16%) the worst performing token in the Gaming/Metaverse sector, while The Sandbox (-6%) fared much better. On the negative side, Microsoft cut a team of 100 people who were focused on helping customers use the metaverse in industrial settings. On the positive side, the Digital Government Authority of Saudi Arabia signed a memorandum of understanding with The Sandbox. Details of the partnership were vague and hopefully more will be announced soon.

Runa Updates:

- Content:

- Runa’s CEO, Jennifer Murphy, had a piece published by CoinDesk that discusses how only a handful of the thousands of liquid tokens today may drive the majority of wealth creation in digital assets, similar to what we’ve observed in the stock market. Read it here: http://coindesk.com/business/2023/02/16/what-fat-tails-and-revolutionary-ages-mean-for-digital-assets/

- On February 6th, Risk.net published an article titled “Stablecoins: good as the buck, or breaking the buck?” which quoted Runa’s Head of Client and Portfolio Solutions, Alex Botte. Alex discussed whether the Federal Reserve might be willing to indirectly extend their reverse repo facility to Circle’s stablecoin, USDC, and the effects of a potential spillover if the largest stablecoin, USDT, were to fail. Read the article here: https://www.risk.net/investing/risk-management/7955944/stablecoins-good-as-the-buck-or-breaking-the-buck

- Past events:

- Jennifer Murphy was a panelist on an FDP/CAIA webinar in late February discussing DeFi and digital disruption. She was joined by other women with long careers in traditional investment management. View the replay here: https://caia.org/videos/tradfi-defi-through-lens-experience

- Upcoming events:

- Jennifer will be sharing her expertise at the upcoming Hedge Fund US Digital Assets Summit on Thursday, March 2nd in New York. Learn more about the event and register your place via the link here: https://lnkd.in/eSdWDz3h Please note that registration for this event is open to GPs and LPs only.

- Jennifer will be a panelist at AIMA’s Digital Asset Forum in New York.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com