This blog post recaps Runa’s TL;DRs in March and is meant to cover the most interesting token performers, crypto data, and news from the month .

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance

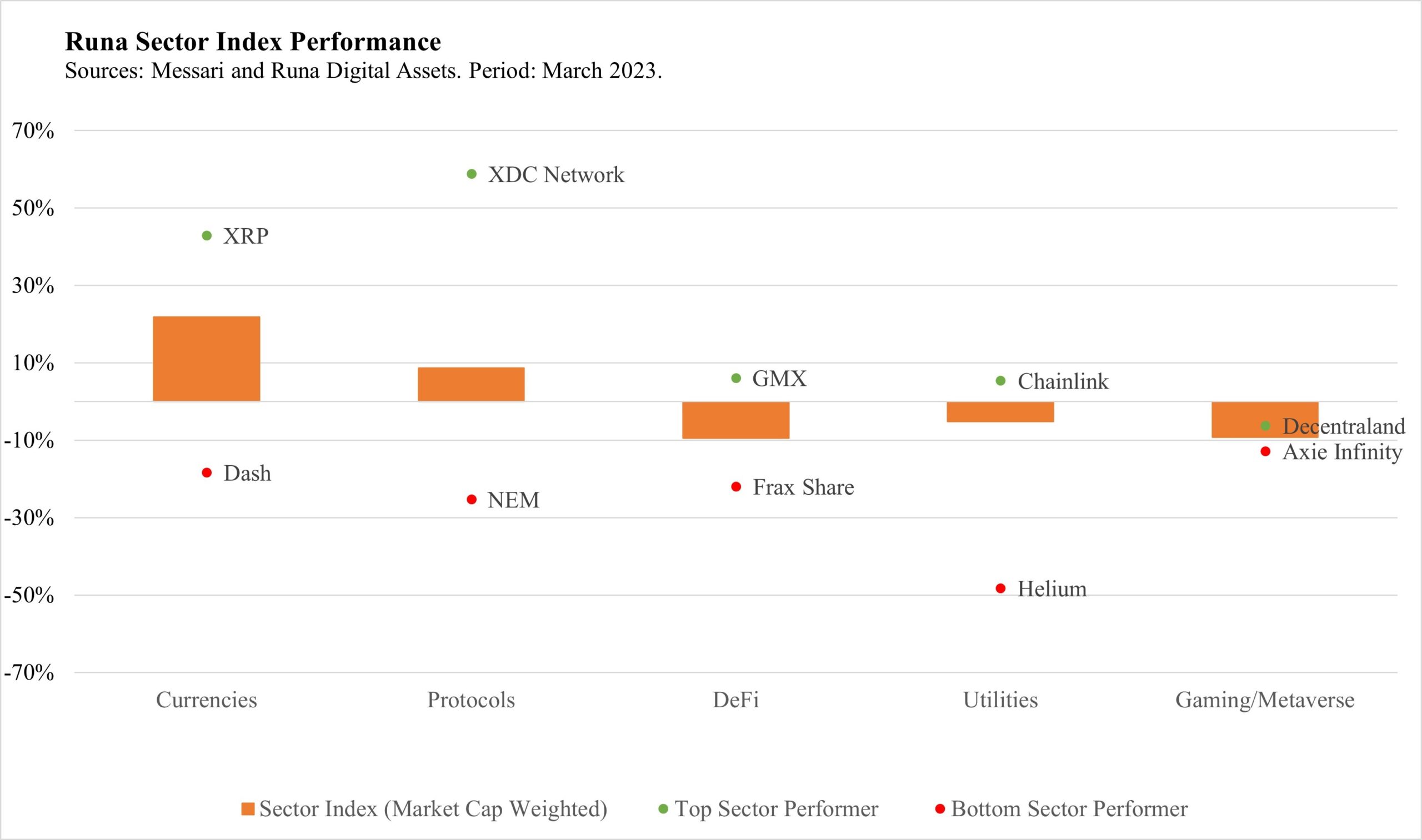

- March was the continuation of a very strong start to the year for digital assets. However, regulatory concerns have continued to mount in the industry – see notable news below.

- XRP (+42.8%) was the month’s top performing asset, as Ripple’s case against the SEC nears its conclusion. Digital asset investors continue to signal confidence that the judge will rule in Ripple’s favor, finding XRP is not a security. This would be a historic win for the industry and may bode well for future digital asset related enforcement actions.

- During March the two true blue chip digital assets, Bitcoin (+23.0%) and Ethereum (+13.5%), led from the front, outpacing many altcoins, which typically would have a higher beta return profile. This trend is reminiscent of price action at the beginning of previous bull cycles.

Notable News

- On March 22nd Coinbase Founder and CEO Brian Armstrong announced via Twitter that the US-based crypto exchange had received a Wells Notice from the U.S. Securities and Exchange Commission. Wells Notices typically come before a formal enforcement action from the SEC. Coinbase has expressed its intention to fight whatever charges may come, positioning the crypto industry for one of its largest and most influential regulatory battles to date.

- In further regulatory news, on March 27th the CFTC filed a complaint against crypto exchange giant Binance. The complaint alleges that Binance offered crypto derivatives to US persons without registering. Details in the complaint appear to show that Binance representatives actively assisted US clients in circumventing US restrictions, certainly cause for concern for crypto regulators and investors.

- Nasdaq announced that they expect to launch their crypto custody service in Q2 of this year. Nasdaq will start by offering clients custody of BTC and ETH. This announcement marks yet another large firm from traditional markets expanding their product offerings into digital assets.

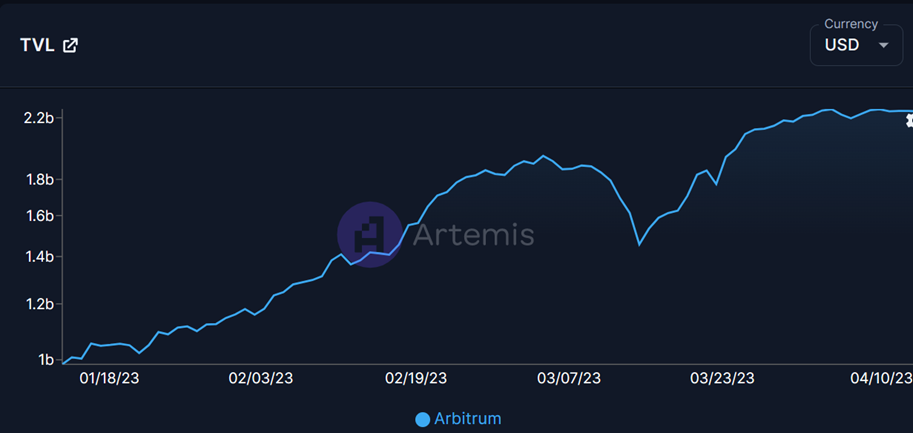

- In March Ethereum layer-2 network Arbitrum conducted its long-anticipated airdrop. Through the airdrop, the network issued ARB tokens directly to individuals who have used the protocol. Today, the total value of the airdropped tokens is $1.6B and usage has held up well, suggesting that Arbitrum users are continuing to use the protocol even after the economic incentives are gone.

Notable Data

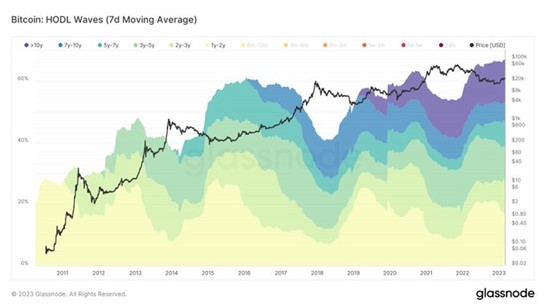

- Reflexivity Research released a report showing that 67% of total Bitcoin supply has not moved in the last 12 months. This fact is indicative of the high conviction Bitcoin holders have, choosing to hold onto the asset despite very significant drawdowns.

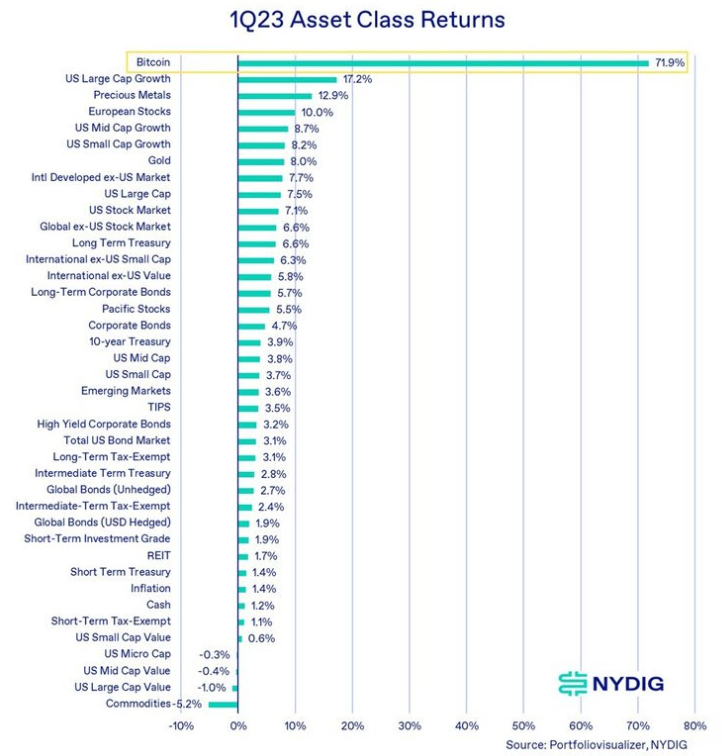

- The conviction of these holders has been rewarded in Q1. The chart below from NYDIG compares Bitcoin’s returns to those of traditional asset classes through the first quarter. This quarter’s impressive 72% return serves as a reminder to investors of the asymmetric upside Bitcoin is capable of capturing.

Runa Updates

- Runa COO Max Williams released his views on Ethereum’s upcoming Shapella upgrade. You can read Max’s full report here and view his segment on CoinDesk TV

- Runa’s Head of Client and Portfolio Solutions Alex Botte, CFA, CAIA discusses her industry-leading risk research on Arbor Digital’s Asset (r)Evolution podcast. You can listen by clicking here.

- The Runa team will be on the road in the second quarter, at Consensus in Austin, The Bitcoin Conference in Miami, and AIMA’s Digital Asset Conference in NYC. If you’ll be attending, we would love to meet with you.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com