This blog post recaps Runa’s TL;DRs in November.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Crypto Performance:

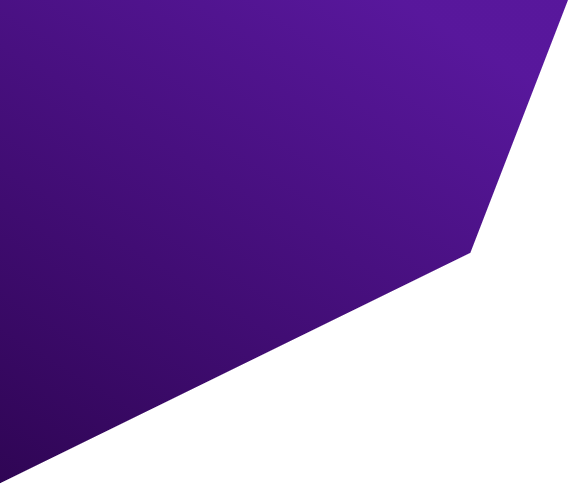

- Runa’s sector indices, which are built using liquid tokens and are market-cap weighted, were all negative for the month. Crypto exchange giant FTX unraveled and filed for bankruptcy, tanking digital asset prices and spreading concerns of additional contagion risk. Concerns regarding FTX’s financial stability began following a leak of their subsidiary, Alameda Research’s, balance sheet early in the month. It appears that FTX was lending customer deposits to Alameda who then would take on risky positions using those funds. The situation culminated with FTX filing for Chapter 11 bankruptcy in the US and disgraced CEO Sam Bankman-Fried stepping down. The ripple effects of this event are still not fully known, but here are a few notable organizations that were impacted:

- The dramatic fall of FTX spurred withdrawal requests that overwhelmed crypto lender Genesis, causing them to suspend redemptions and new loan originations. This then led to Gemini, another centralized crypto exchange and custodian, pausing their Earn program, which partnered with Genesis to generate yield for customers that wanted to earn interest on their crypto deposits.

- BlockFi, a centralized crypto lender that was under stress in May/June and was rescued by FTX at the time, filed for bankruptcy toward the end of the month. FTX and Alameda Research owe the firm more than $1 billion.

- Two of the weakest performers were Solana (-57%) and Serum (-70%), as both were adversely affected by the collapse of FTX and Alameda, who held significant amounts of each asset and sold off these holdings in a last-ditch attempt to be able to meet client withdrawal requests.

- On the positive side, Litecoin (+44%) was the top performer and was at least partially supported by a positive narrative around the blockchain’s halving in 2023 (there will be a 50% reduction in newly minted LTC).

Notable News:

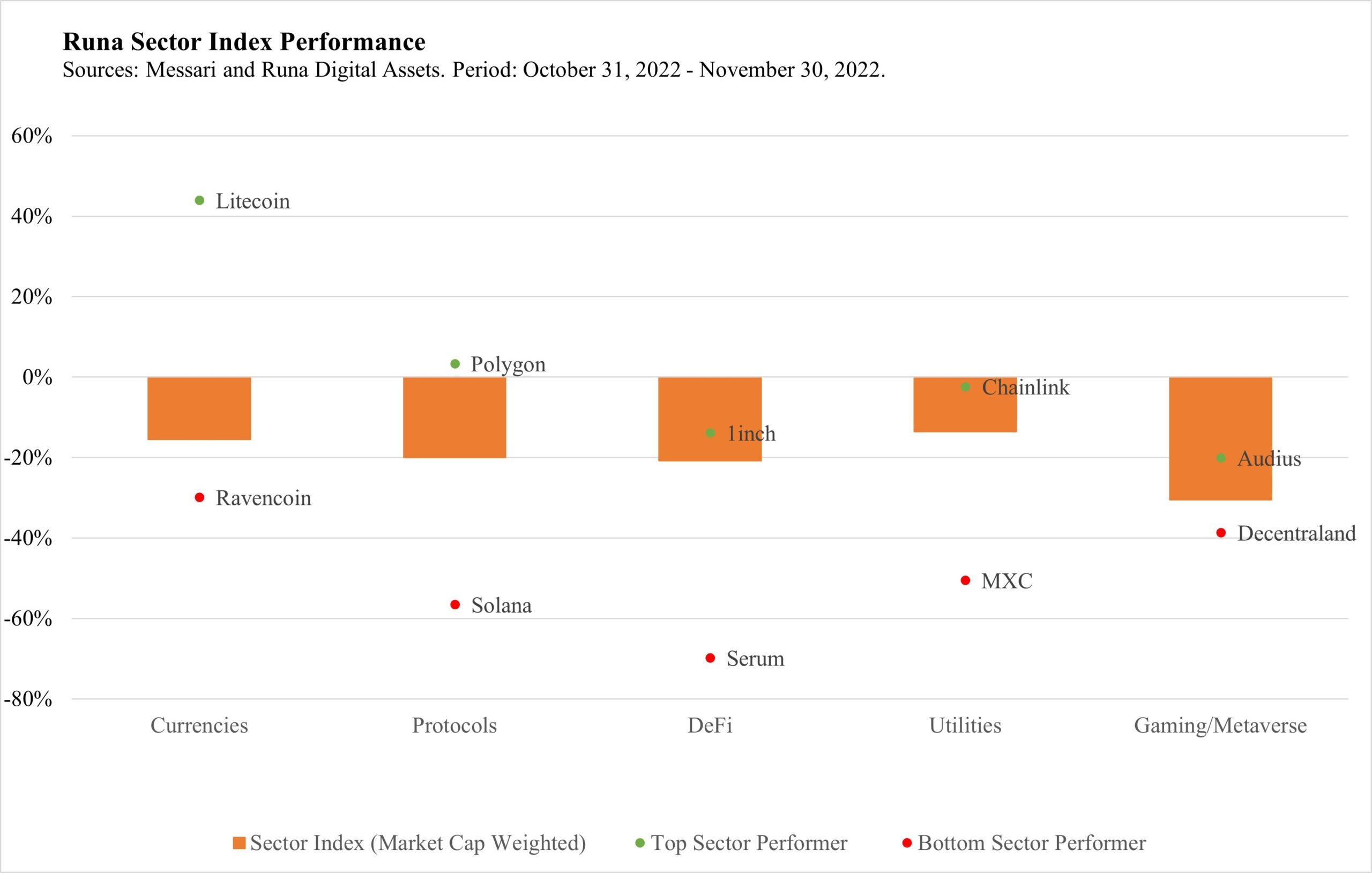

- Arweave (-7%) was an outperformer in the Utilities sector after Meta (formerly Facebook) made an announcement around their NFT plans. Instagram creators will be able to mint and sell digital collectible NFTs using the Polygon (+3%) blockchain, and the NFT data will be permanently stored on Arweave. Arweave is a decentralized storage protocol that allows its users to store data endlessly online for a one-time fee. Data usage on its network notably increased in early November as a result of its new customer, Meta.

- JP Morgan completed a live, on-chain cross-currency transaction involving tokenized Japanese yen and Singaporean dollar deposits. The trade occurred on Ethereum (-18%) layer 2 network, Polygon, and leveraged Aave’s (-22%) permissioned pool concept. We view this as a major milestone for the adoption of decentralized finance on public blockchains by traditional institutions.

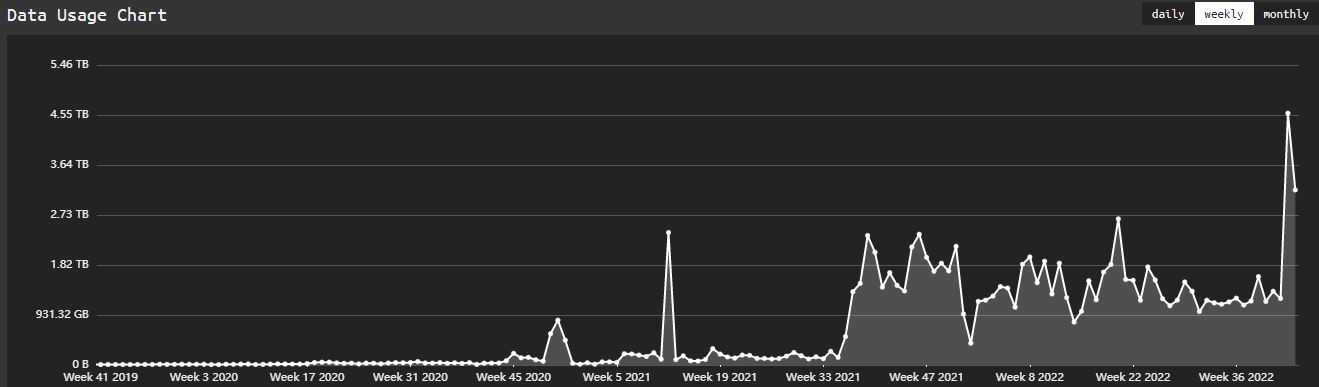

- On November 8th, ETH supply since the Merge in September went negative, meaning the network was deflationary (it is now back to flat, meaning ETH supply has effectively been steady since the Merge). This event marked a hugely important moment for the investment properties of ETH and provided a rare bit of positive news during this tumultuous month.

- Nike expanded their Web3 initiative by launching a platform called .Swoosh that will offer digital apparel (like t-shirts and sneakers that can be put on avatars in Web3 games and metaverses) represented as NFTs that are minted on Polygon. Nike is not a newcomer to Web3 – in 2021 they acquired RTFKT, a Web3 studio brand, and they minted NFT metaverse sneakers called CryptoKicks on Ethereum earlier this year.

Runa Updates:

- Upcoming events:

- Runa’s COO, Max Williams, and Head of Client and Portfolio Solutions, Alex Botte, will be attending the iConnections Global Alts conference at the end of January. Please reach out if you’d like to meet up.

- Past events:

- Max discussed the FTX fallout, as well as DeFi and NFT use cases, at Oppenheimer’s virtual Blockchain & Digital Assets Summit. More generally, the conference focused on the development, opportunities, and challenges of moving towards Web3. Please reach out if you’d like the notes from Max’s panel.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com