This blog post recaps Runa’s TL;DRs in September.

Crypto Performance:

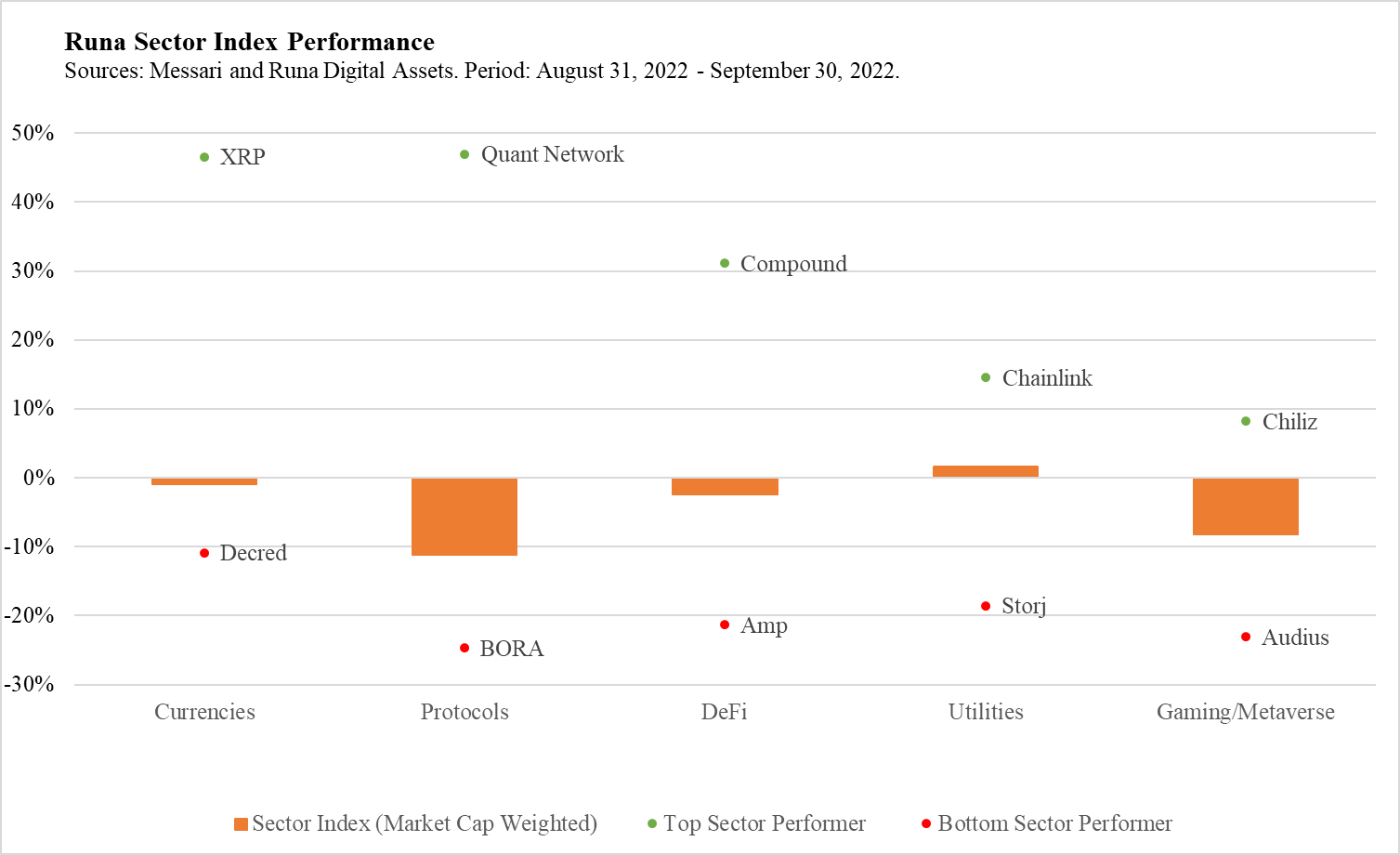

- Runa’s sector indices, which are built using liquid tokens and are market-cap weighted, were mostly negative for the month. The Utilities sector was the exception, posting the best performance at +2%.

- XRP (+47%) was a top performer, as both Ripple and the U.S. Securities and Exchange Commission filed motions requesting a summary judgment in the SEC’s suit against Ripple. This judgment will be a landmark decision in the history of digital asset regulation and will determine whether or not Ripple violated securities law through their sale of XRP tokens. XRP rallied with investors speculating about the nature of the upcoming judgement.

Notable News:

- Warner Music Group announced a newly formed collaboration with NFT marketplace OpenSea. This partnership could open the door to mainstream musical artists selling their work on the platform, giving said artists an opportunity to monetize their work more efficiently than they can through traditional streaming platforms.

- Fidelity Investments is reportedly considering adding $BTC (-3%) to its online brokerage platform, allowing 34 million individual investors to access the asset.

- Additionally, Fidelity, along with Charles Schwab, Citadel Securities, and others, announced a new crypto exchange called EDX Markets. These investments by traditional finance firms are particularly notable given the crypto downturn.

- Nasdaq announced they will be launching an institutional digital asset custody service. This product will allow institutional investors to custody Bitcoin and Ethereum (-14%) and marks yet another traditional finance giant announcing plans to enter the digital asset space.

- Maple Finance, a decentralized corporate credit platform built on Ethereum and Solana (+6%), announced a new pool that will be dedicated to lending to Bitcoin miners and infrastructure providers. The pool will have a capacity of $300M. We think this is a major development, as this is a new borrower profile for Maple Finance. Previous pools have focused on lending to institutional crypto market makers.

Runa Updates:

- Research:

- The CAIA Association published our second article in a risk factor model series we are developing. This latest research explores whether it makes sense to add certain macro factors to a crypto-specific risk factor model alongside crypto beta.

- If you want to learn more, please watch the 7-minute video here: https://lnkd.in/enrhC8mp

- Read the full report here: https://lnkd.in/e3HBswVR

- The CAIA Association published our second article in a risk factor model series we are developing. This latest research explores whether it makes sense to add certain macro factors to a crypto-specific risk factor model alongside crypto beta.

- Upcoming Events:

- Jennifer Murphy is speaking on an NFT panel at a virtual event by the CFA Philadelphia Society in mid-October. Registration details to come.

- Max Williams is speaking about DeFi and NFTs at Oppenheimer’s 5th Blockchain & Digital Assets Summit on November 17.

- Past Events:

- Jennifer spoke at an Investment Adviser Association forum on policy and leadership in DC before flying to Zurich to participate on a panel at AIMA’s European Digital Assets Forum. At the latter event, she provided an overview of the digital asset landscape and expectations for the growth and development of institutional adoption.

- Alex Botte equipped attendees at CFA Orange County and Bloomberg Women’s Buy-Side Network events with ways to apply traditional investment analysis to digital assets across sectors, valuation methodologies, and risk frameworks. Replays for both are coming soon.

- Max and Alex attended Messari’s Mainnet conference, and Ned Menton attended Blockwork’s Digital Assets Summit, both in NY. At these conferences, the team heard from and networked with industry leaders on topics like regulation, the state of crypto markets, and investing through the crypto winter.

- Finally, Max and Alex tested their pickleball skills in a CFA Society San Diego event. They met other CFA charter holders and even some folks building in the crypto space.

FYI: Runa’s weekly TL;DRs are posted to our LinkedIn account at the end of every week. Follow us on LinkedIn here to get our weekly TL;DRs on your newsfeed.

Questions? Thoughts? Feedback? Shoot us an email! info@runadigitalassets.com